As the world’s largest pork producer warned of a possible bacon shortage, bacon lovers around the globe expressed a collective gasp! That’s right, Smithfield Foods Inc. stated that America could see either tight supply lines, or possibly shortages of pork bellies, in addition to ham, in 2020 as a result of the spread of a disease in China which kills pigs. This disease could result in global market disruption and subsequently a bacon shortage.

African swine fever has hit hard at hog farms in China, and although Smithfield Foods Inc. tried to break the news to the market gently, the fact that the pork supply may see a shortage in the U.S. next year is nothing to sneeze at. This potential ripple in the global market could mean great tidings for American pig farmers, according to the Virginia-based company. However, it might also mean a shortage due to an inability to meet the market demand, according to reports by Bloomberg.

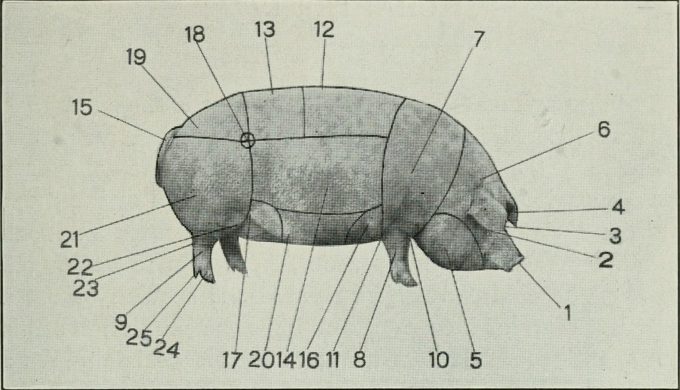

Photo: Flickr/Internet Archive Book

Experts have stated that the pork production in China could be cut by as much as 50 percent by the end of 2019. According to NPR, this would result in close to a quarter of the global pork supply effectively being removed from the table. Pork is considered a staple in China, where half of the global pig population can be found. If the market can’t support their demand, the prices will begin to climb. Smithfield Foods Inc. said that they’ll prioritize the supply of pork to its long-time American customer base, but strong demand from China could result in some U.S. pork exports flowing to Asia, with some cuts seeing particular tightness.

Photo: Geograph

The Texas Pork Producers Association will likely be monitoring this situation quite closely as 2019 draws to a close. Their “Recent News” tab on their official website has yet to identify or corroborate these reports and will most certainly be updated to reflect what’s current for local producers. According to CNBC, American pork only accounted for approximately 14 percent of Chinese meat imports in 2017. This was roughly equal to the year previous. However, by early 2018, that figure had dropped to only eight percent as tensions escalated in trade. By the end of 2018, it had dropped to as low as two percent. Further report analysis has since shown a recovery to approximately eight percent by May of this year, and with this new development, there’s strong hope for U.S. producers to fill the void.